|

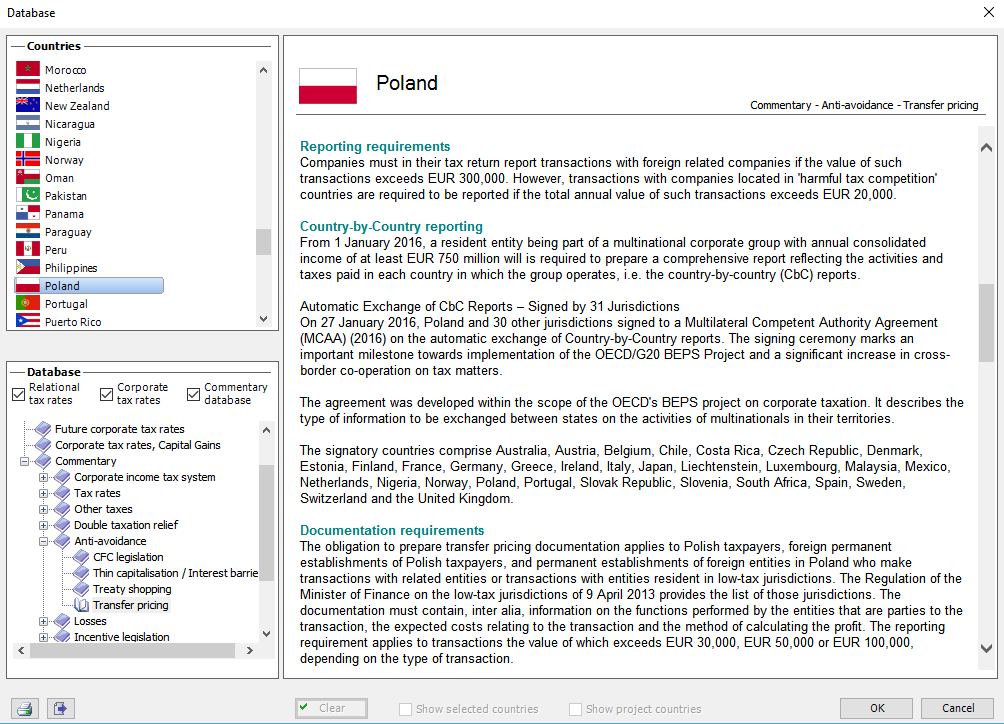

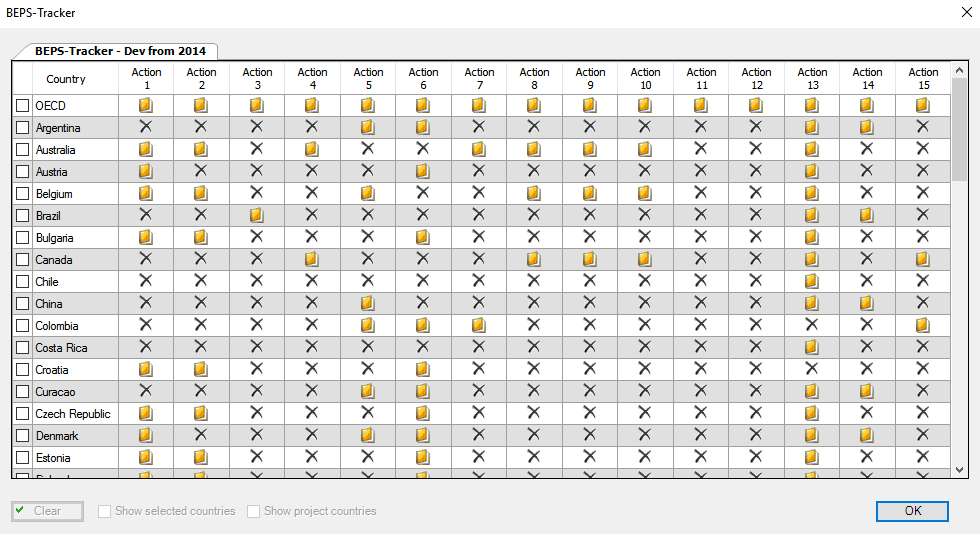

December has undoubtedly been an eventful month for Action 13. US and Denmark announced draft documentation format for CbC Reports, Sweden presented proposed legislation to implement OECD recommendations on CbC Reports and French Constitutional Court held that the scope of information required by the Report is unconstitutional. In other words, the nearby end of 2016 for many will mean that the practical impact of BEPS is relation to CbC Reports is just about to start. And certainly, there are still things to be done. OECD Guidelines on Implementation of Country-by-Country Reporting recommended legal framework to be effective for fiscal periods commencing on or after 1 January 2016. Up to date over 20 jurisdictions have already in place required legislation and more than 30 have either a proposal or at least an intention to participate in Action 13. The scope of application however will differ not only in terms of required documentation, thresholds but also deadlines and transition periods. Countries such as Australia, China and Poland introduced significant changes to domestic transfer pricing legislation in order to adapt to OECD recommendations. In 2017 MNEs will be expected to submit not only the CbC Reports but also Local and Master File in respective jurisdictions. However, before the submission of CbC Reports, multinationals might be also required to send notification to tax authorities in which they will identify the Reporting Entity for the MNE Group (based on Art 3 of the Action 13). For many countries, the deadline to submit such notification will pass on 31 December 2016 (for instance Austria, Bulgaria, Denmark, Ireland, Spain if filed by the ultimate parent or surrogate parent entity) while others already announced the possibility of extending the deadline till 2017 (the Netherlands, Belgium, Portugal) under specified circumstances. Additionally, countries that do not have a formal implementation of Action 13 in place still provide notification deadline for CbC Reports (Brazil, Sweden, Czech Republic, Estonia, Slovakia). Moreover, countries adopted different strategies in relation to Local and Master Files. Differences are significant and non-compliance may result in penalties which also differ: from daily penalties for late submission, adjustments in taxable profits to lump sums up to $450 000. While in Austria the Master File needs to be submitted within 30 days upon request by the tax authorities, in Poland it has to be submitted no later than the filling of the annual tax return or 7 days upon the request by tax authorities). On the other hand, not all countries will require additional compliance in a form of Local and Master File as domestic transfer pricing legislation already requires to present similar type of information (e.g. France and Estonia). Those responsible for submission of documentation should also be aware in what languages documents need to be prepared as sometimes only in national languages will be accepted (e.g. Poland and China). Comtax® Database as well as BEPS Tracker allow to monitor relevant changes in terms of documentation requirements and filling deadlines. All information can be found either in the database under Commentary section and Anti-avoidance/Transfer Pricing headline. Alternatively, the BEPS Tracker allows a fast search for developments only related to BEPS. If you have any further questions regarding Action 13 implementation or using Comtax®, please contact us at: sales(@)comtaxit.com.

Comments are closed.

|

Archives

March 2024

|

COMTAX ABC/o Ekonomiforetaget Baehring Dahl AB

Berga Alle 3 25452 Helsingborg Sweden |

CONTACTTel.: +46 46 590 07 70

E-mail: support(@)comtaxit.com |

INFORMATION |

© COPYRIGHT 1985 - 2024 COMTAX AB. ALL RIGHTS RESERVED.