|

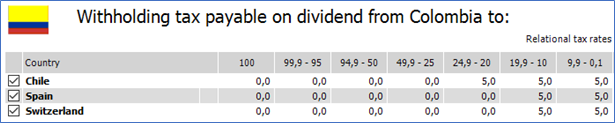

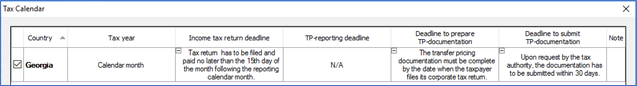

While the post-BEPS legislation changes aim at preventing tax abuse and profits’ shifting, governments still aspire to attract business investment by means of tax incentives, legal transparency and simplification of tax compliance. With effect 1 January 2017 Colombia and Georgia significantly amended their tax systems in order to increase their revenue stream from corporate taxpayers. Although both reforms represent different approaches, this brief outline will explain how the relevant changes have been implemented in Comtax®. Colombia The most significant changes include simplification of corporate tax rate, abolishing fairness tax (CREE) on corporations and surcharge, introduction of 5% withholding tax on dividends paid to non-residents if dividends are paid out of profits taxed at the corporate level and introduction of CFC regime. The new corporate income tax rate has been set at 34% for 2017 plus an additional 6% temporary surtax as opposed to previous rate of 25%, 9% CREE and 6% CREE surcharge. For 2018 the corporate tax rate will be 33% and 4% temporary surcharge and in 2019 the CIT is set to be 33% without surcharge. Relational tax rate for the new 5% withholding tax for dividends have been updated in Comtax database, together with relevant tax treaties (i.e. tax treaties with Chile, Spain and Switzerland include 0% withholding tax on dividends). Dividends paid out of profits which were not subject to corporate income tax will be subject to 35% withholding tax. Colombian taxpayers will be subject to tax on income (including passive income) on a proportionate share if they own directly or indirectly min. 10% in an entity considered as CFC. More information about CFC in Colombia can be found in our Commentary under the headline Anti-avoidance/CFC legislation. Georgia Effective 1 January 2017 Georgia implemented the ‘Estonian system’ where only the distributed profits are subject to tax (however banks, credit units, insurance organisations will be still subject to the old taxation system until 1 January 2019). Although the corporate tax rate remains unchanged (15%), the taxable amount will now have to be divided by a coefficient 0.85. Similarly to Estonia, Georgia will also implement a calendar month as a taxing period; more information about tax returns and payment of tax can be found in our Tax Calendar. Taxation of only distributed profits implicates that foreign source dividends received in Georgia will no longer be subject to tax. However, dividends received from resident entities classified as low-tax jurisdiction will be considered as hidden profit distribution and therefore subject to tax. On the 26 December 2016, Georgian Ministry of Finance issued a new low-tax jurisdiction list, which can be found in our Commentary under Anti-avoidance/Black list. Additionally, transactions with related parties that do not satisfy the arm’s length standard, or with entities not subject to income tax might also be considered as a form of a distribution of profits.

As a consequence of the reform, thin capitalisation rules, depreciation rules and loss carry forward will cease to apply. More information about the tax reform can be found under relevant headlines in the Commentary section. |

Archives

March 2024

|

COMTAX ABC/o Ekonomiforetaget Baehring Dahl AB

Berga Alle 3 25452 Helsingborg Sweden |

CONTACTTel.: +46 46 590 07 70

E-mail: support(@)comtaxit.com |

INFORMATION |

© COPYRIGHT 1985 - 2024 COMTAX AB. ALL RIGHTS RESERVED.