TRANSFER PRICING NEWS Colombia – transfer pricing as part of tax reform Colombia’s most recent tax bill significantly modified the existing tax system. Amendments also include changes to the current transfer pricing regime. The most important changes cover sections 260-3, 260-5 and 260-7. Section 260-3 introduces CUP method as the most appropriate (but not mandatory) for establishing AL prices for transactions involving raw materials and basic products. Further, section 260-5 aligns Colombian transfer pricing documentation with BEPS Action 13 on local and master file. Lastly, section 260-7 modifies the meaning of tax haven for transfer pricing purposes to include non-cooperative jurisdictions and special regimes. India – introduction of secondary adjustments for transfer pricing purposes India seeks to implement secondary adjustments for transfer pricing purposes in order to comply with OECD Guidelines. Secondary adjustments which may take form of constructive dividend, equity contributions or constructive loans constitute a follow up to primary adjustments of profits allocation. According to the draft, secondary adjustment will not be necessary if the primary adjustments does not exceed Rs 1 crore (INR 10 million). The amendments are expected to become effective from 1 April 2018. TREATY NEWSAustria and Japan signed tax treaty on 30th January 2017. Azerbaijan and Denmark signed tax treaty on 17th February 2017. Hong Kong and Pakistan signed tax treaty on 17th February 2017. LOCAL TAX NEWSGreece – publication of non-cooperative jurisdictions

Greek Ministry of Finance published a list of non-cooperative states which include: Andorra, Antigua and Barbuda, Bahamas, Bahrain, Barbados, Brunei, Cook Islands, Dominica, Grenada, Guatemala, Hong Kong, Lebanon, Liberia, Liechtenstein, Former Yugoslav Republic of Macedonia (FYROM), Malaysia, Marshall Islands, Monaco, Nauru, Niue, Philippines, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines, Samoa, Uruguay, US Virgin Islands and Vanuatu. The list impacts substance requirements for tax payers who wish to deduct expenses from transactions with residents registered in the above-listed territories. Otherwise, the corporate income tax withheld in order to deduct relevant expenses, will not be refunded. Uruguay – changed criteria for low and no-taxation jurisdictions Ministry of Finance published modified criteria for determining low and no tax jurisdictions:

With the forthcoming requirement to report Country-by-Country (CbC) data to tax authorities in the Organisation for Economic Co-operation and Development (OECD) and G20 countries, it is important to make sure you have proper systems in place to help you. The BEPS 13 reporting tool by Palantir is a cloud based solution which will give you a tool to solve your reporting and analysis requirements efficiently. The solution provides you with an efficient and customizable solution with a modular approach to maximize flexibility. This gives you the option to enable only the modules which will help you in your work and build a solution free from superfluous distractions. The BEPS 13 / Transfer pricing solution will give you a tool for collecting, structuring, analyzing, and presenting all your transfer pricing and BEPS 13 related documents and figures, stored in one place, with you in control. Administration requirements are minimized, and data entry and review are streamlined with efficient capture and search functions. The solution includes support for:

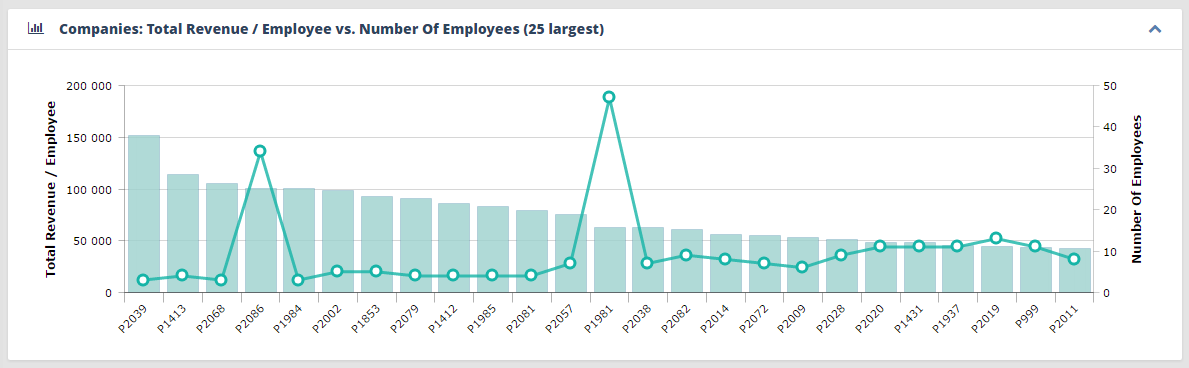

The solution is easy to implement and roll out throughout the organization. You can effortlessly scale up to include add-on modules outside of the Transfer Pricing domain, such as Tax exposure reporting, Tax Compliance management or a full Company Register. The solution can also integrate with your other systems to avoid double entry of data. The Analytics add-on module will help you to analyses your CbC figures in order to identify potential risks and work proactively to mitigate them. You will be able to define your own Key Performance Indicators (KPIs) and set thresholds to utilize the system to find potential risks. You can also work with the reported CbC figures to identify areas of interest and present them in various charts and graphs.

The solution includes a number of functions which will facilitate your work and give you powerful analytical possibilities. Combine analysis of KPIs and what business activity a company has reported to identify risks for certain types of business activity, or follow the Effective Tax Rate (ETR) and its deviation from the statutory tax rate. Our solution keeps track of historical data which allow you to follow risks over time and apply the correct basis for each year (such as historical statutory tax rates). For more information contact please contact us at [email protected]. |

Archives

March 2024

|

COMTAX ABC/o Ekonomiforetaget Baehring Dahl AB

Berga Alle 3 25452 Helsingborg Sweden |

CONTACTTel.: +46 46 590 07 70

E-mail: support(@)comtaxit.com |

INFORMATION |

© COPYRIGHT 1985 - 2024 COMTAX AB. ALL RIGHTS RESERVED.