-

125+

Tax Jurisdictions

-

1000+

International Tax Users

-

10000+

Effective Tax Rates

Join Thousands of International Tax Users Across Industries And Continents

SPEED. PRECISION. ADAPTABLE.

Everything you need to master the complexities of ever-changing international tax law with confidence and clarity.

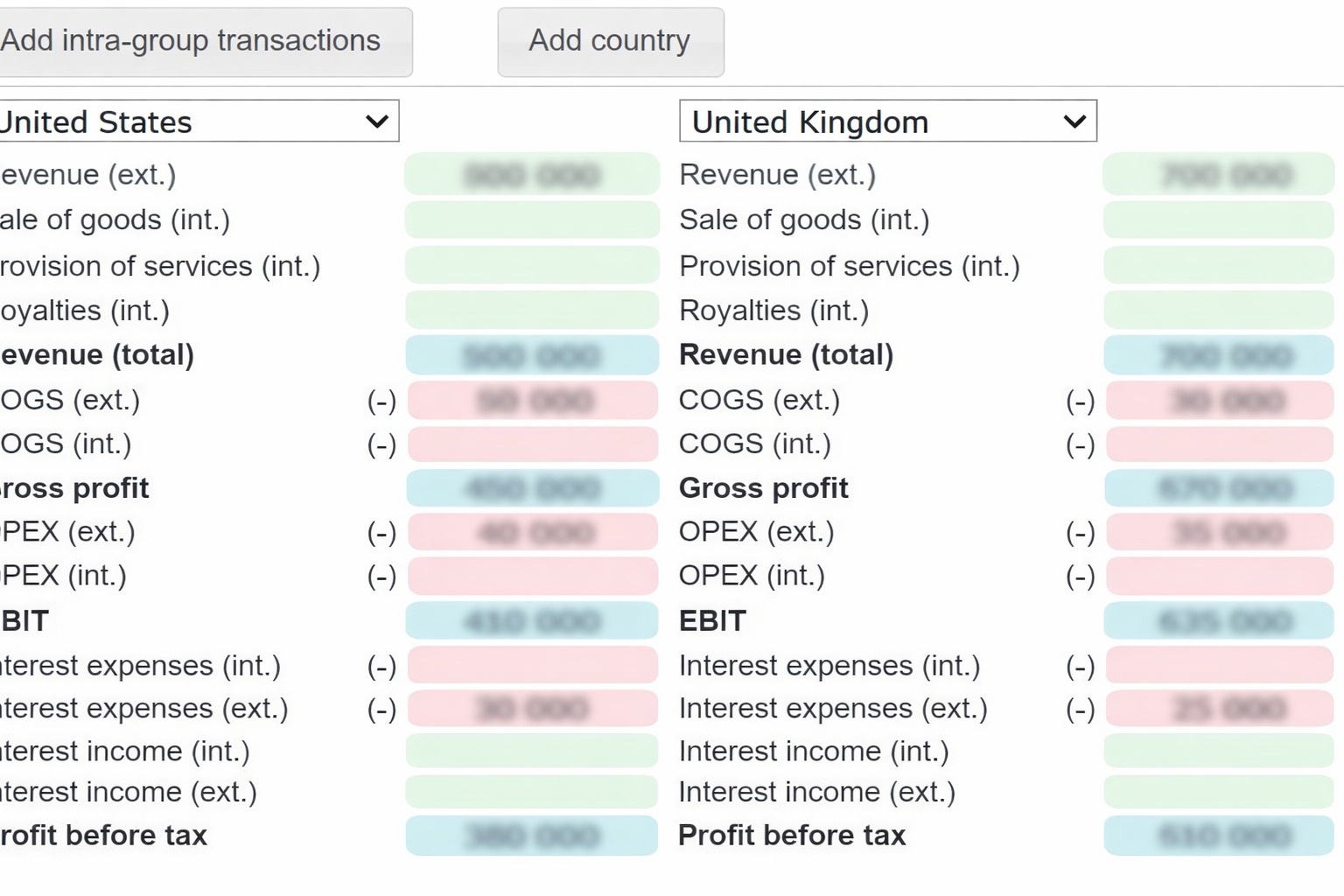

Analyze cross-border corporate tax liability

Model cross-border corporate tax outcomes across 125+ jurisdictions — instantly.

Changeable tax rates

Run “what-if” analysis by adjusting effective tax rates in real time.

Save, print or export

Turn tax calculations into shareable insights in seconds.

Effective tax rates

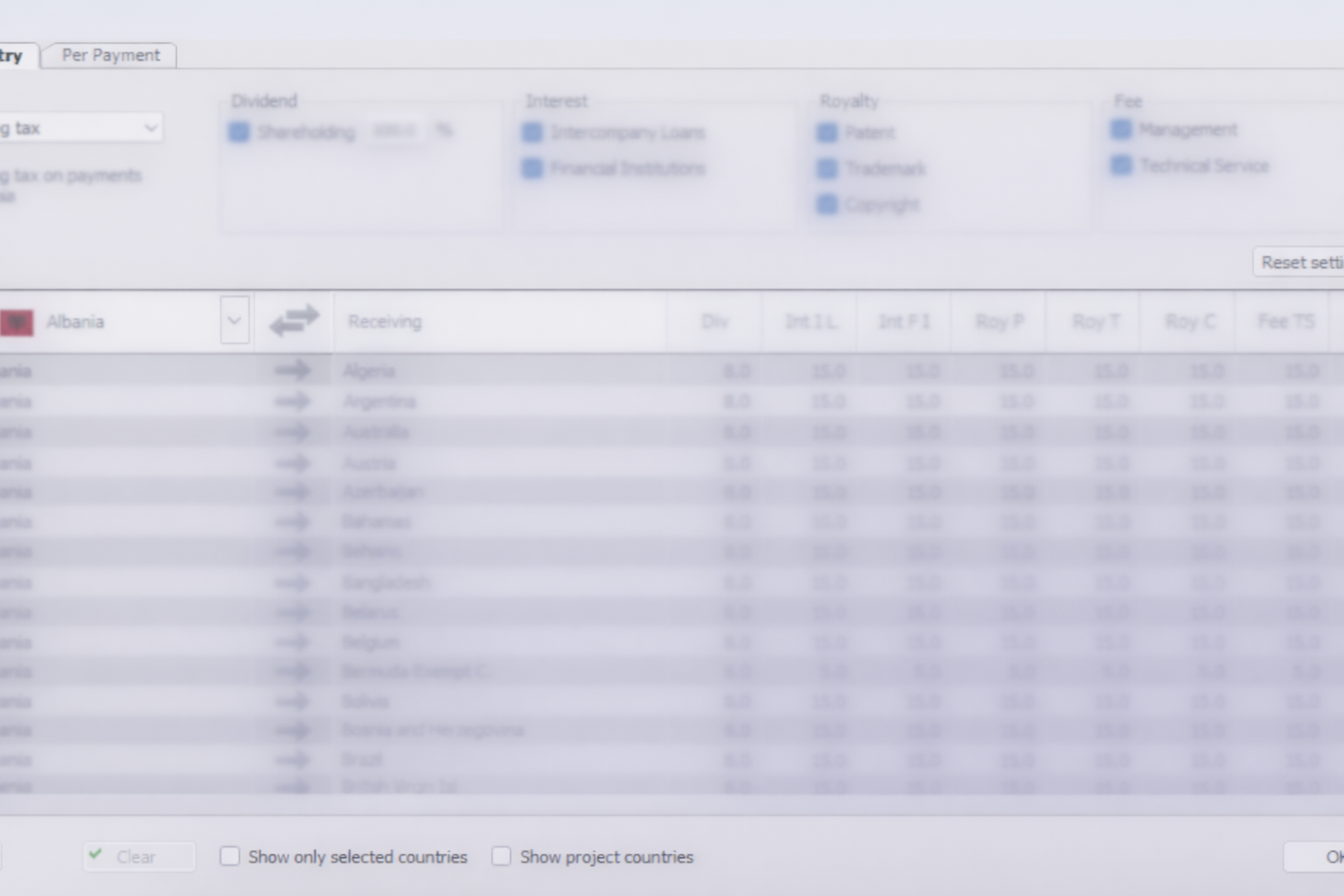

COMTAX stands out by incorporating treaty-reduced effective tax rates into its calculations. It covers dividends, interest (including intercompany loans and financial institutions), royalties (patents, trademarks, scientific copyrights), and management and technical service fees.

Customizable settings

Fine-tune inputs and generate precise cross-border tax outcomes instantly.

Add, remove or rename a country

Accommodate multi-entity structures within the same jurisdiction in cross-border transaction modeling.

World's First And Most Powerful Tax Intelligence Tool

Navigate through complex and ever-changing international tax landscape with confidence, speed, and efficiency. Accessible anytime via cloud, or securely on your desktop!

AI-Driven Cross-Border Tax Calculation Tool

A powerful technology-driven tool that displays the international tax consequences when repatriating dividends, interest, royalties, or fees from one company (source country) to another company (ultimate recipient), directly or indirectly via other companies.

Effective Tax Rates

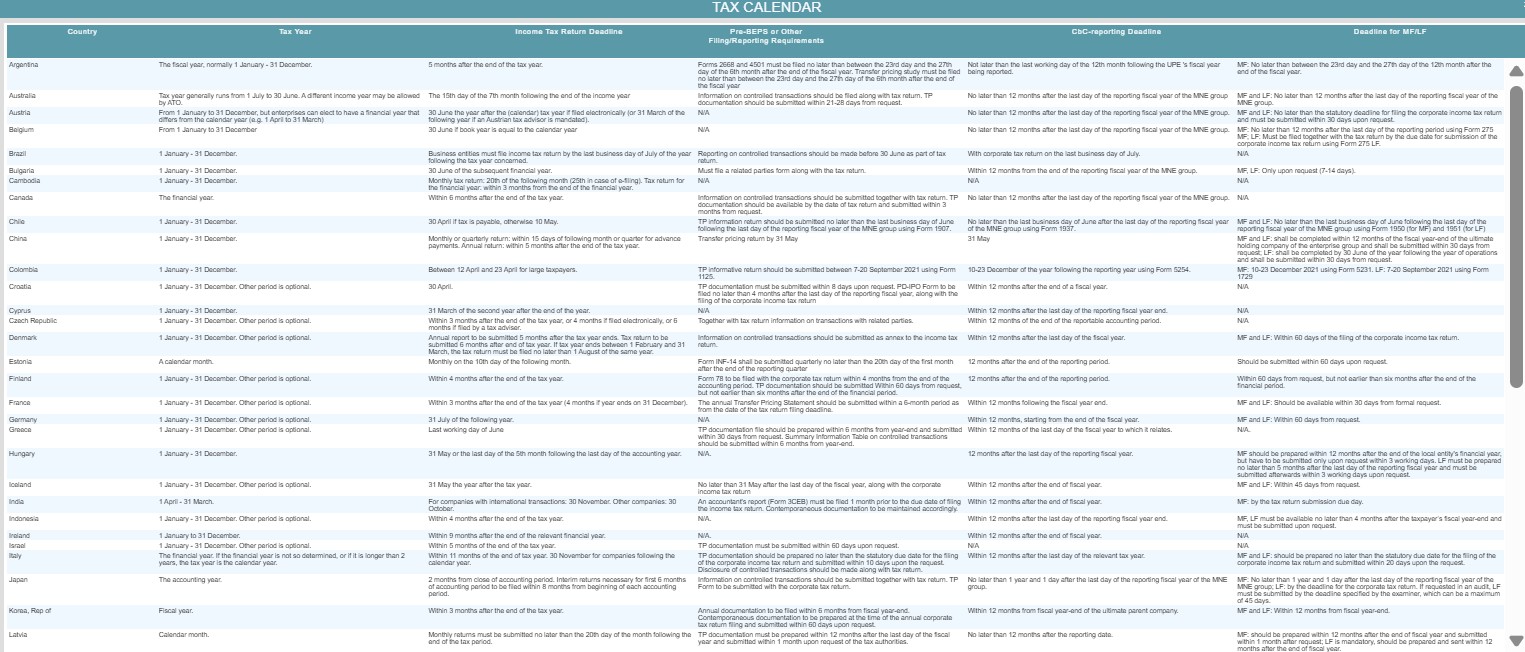

Our database provides up-to-date effective tax rates (as modified by tax treaties) for over 125 tax jurisdictions for the following: corporate tax, capital gains tax on sale of shares, and withholding tax on cross-border payment of dividend, interest, royalty, and fees.

Worldwide Tax Commentaries

Our continuously updated Tax Guide provides useful information under relevant topics for analyzing the simulations of different types of payments for over 125 tax jurisdictions that COMTAX covers.

Capital Gains Analysis

Our optional Capital Gains Module allows you to make simulations covering the tax effects of cross-border sales of shares.

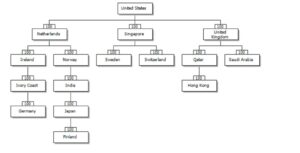

Ownership Structures

A group structure reflecting ownership can be built into the project as a condition for the calculation when it comes to dividend payments.

What COMTAX Offers

AI-powered international tax solution designed to help MNEs, tax advisers and CPA firms navigate through complex and ever-changing international tax landscape.

About COMTAX

Accurate, Reliable & Up-to-date International Tax Solution Trusted by MNEs, Tax Advisers, & CPA Firms

The mission of COMTAX is to empower international tax teams by simplifying complex and ever-changing international tax landscape through a combination of human and artificial intelligence. This is what we have been doing since 1985.

We adopt a structured, research-based methodology combining advanced technology, industry intelligence, and rigorous execution to ensure measurable cross-border tax outcomes, operational excellence, and long-term value creation.

COMTAX comprises a strong team of highly experienced international tax lawyers who ensure consistency, continuity, and accuracy so that our users are not working from stale figures.

Why COMTAX?

COMTAX is the only company worldwide to offer a tax management software suite, specially tailored for international tax professionals.

Are you a?

Empower Your In-House Tax Teams

MNEs can easily verify external tax advice with the help of COMTAX solutions and our own in-house international tax and technical support.

Get Rid of Error-Prone Spreadsheets

COMTAX offers a personalized system unique to your circumstances so you are not forced back into error-prone spreadsheets when a case falls outside a standard template.

Impress Your Client With the Power of COMTAX

Large tax advisers will find the power, speed, and accuracy of COMTAX extremely addictive. COMTAX enables you to calculate corporate tax liability of cross-border transactions literally in seconds, even during high-stakes meetings.

Make Your Daily Tax Work Faster & Effective

COMTAX helps you in navigating thousands of tax treaties across jurisdictions, and positioning group entities, or exploring alternative tax structures to achieve optimal tax outcomes for your clients when repatriating cross-border payments.

Trusted by MNEs, Tax Advisers & CPA firms

See what MNEs, Tax Advisers & CPA firms have to say about COMTAX!

Resources & Insights

Our international tax team tracks every single news update in the international tax world so you do not have to!

09 February, 2026

09 February, 2026

Tiger Global loses Indian international tax dispute

The Indian Supreme Court has held that the 1.6 billion dollar transaction entered into by Tiger Global is an impermissible tax-avoidance arrangement. The investment firm…

09 February, 2026

09 February, 2026

OECD releases revised MAP manual

The OECD has released updated guidance…

09 February, 2026

09 February, 2026

Japan, Philippines to sign new tax treaty

Japan and Philippines have agreed in…

Ready to simplify your global tax operations?

Tax professionals around the world use COMTAX to support cross-border tax decisions. Schedule a personalized demonstration to explore our capabilities in the context of your organization.

Free, Fast Demo

No Commitment Required

Expert Support

24/7 dedicated team

Quick Setup

Start in seconds, not days

Unlock the power of technology-driven cross-border tax solution

-

125+

Jurisdictions Covered

-

1000+

International Tax Professionals

-

10000+

Tax Rates